Market Commentary: Gold, Australian Gold Stocks (14th-19th April 2025)

April 22, 2025This week, gold saw record high prices across the United States and Australia, with prices of above US$3,350 and A$5,261 respectively.

However, gold prices retreated slightly on Thursday following a significant US$110 gain, as traders prepared for the long Easter weekend, with market participants seeking to square their positions by taking profits and closing their long positions. It seemed that the traders weren’t keen on holding positions in both equities and gold, with both the asset classes seeing a slight price correction just before market close, especially in anticipation of the continued downward trend in the equities markets due to global trade wars and recessionary fears.

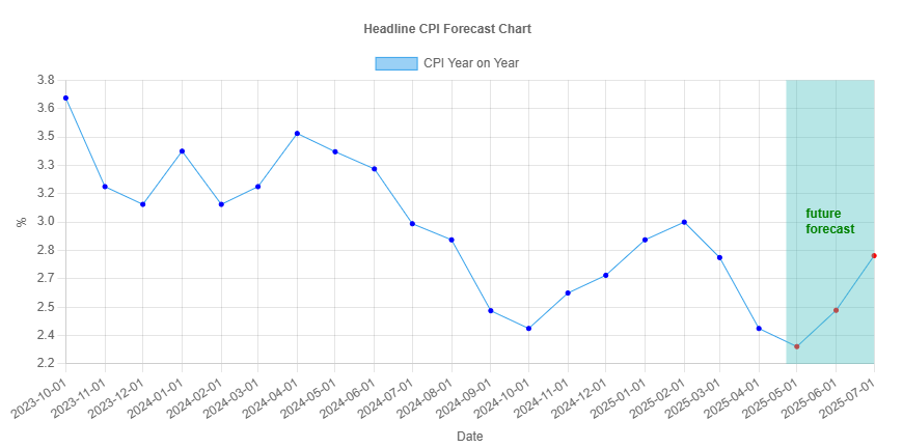

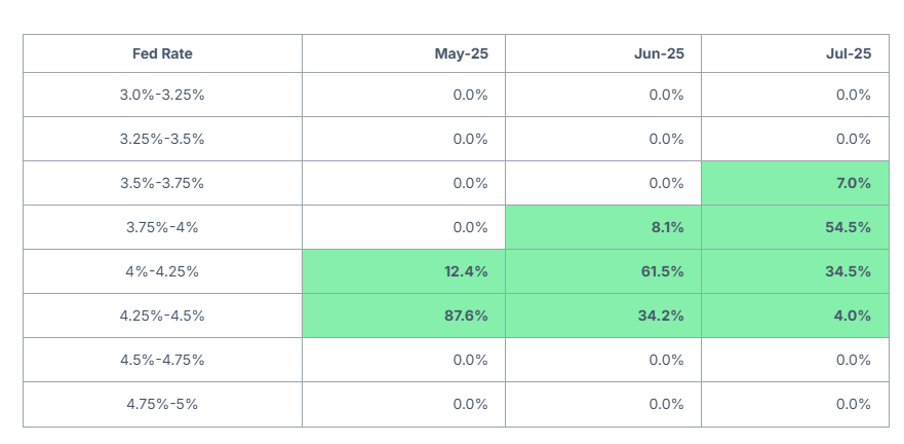

However, notably, the US-dollar index breached a critical technical support level after a long time, with a value of 99.40. This trend of a weakening dollar due to current trade wars and geopolitical uncertainties is most definitely conducive for gold’s bull run, but investors have to be cautious. This is because investor optimism was tempered by Federal Reserve Jermey Powell’s statements pointing out that the central bank could exercise caution in interest rate cuts. Powell’s statements on rising inflation scares due to tariff policies being temporary but persistent also reduced the probability of an interest rate cut from 14.7% to 13.2% this week, leading to a slight correction in gold prices. However, the weakening of the US dollar, coupled with rising inflationary scares associated with current geopolitical tensions seem to overpower the effects of a slightly lower probability of interest-rate cuts, as gold continues to outshine other asset classes. This is because, ultimately, in light of the current macroeconomic environment, it is inevitable for investors to rush to gold as a safe-haven, which is reflected in increased spending from the central banks on gold too. Therefore, any price correction in gold at the moment seems to be a buy.

Figure 1: Headline CPI Forecast Chart for June-July 2025

Figure 2: Fed Rate Probability for May-July 2025

Similarly, silver has also increased over 10% in value since April 7, despite a slight retreat similar to gold this week. However, silver hasn’t been able to keep up pace with gold, with the gold-silver ratio rising to its highest since mid-May 2020 (102.151).

On 15th April, Evolution Mining released their quarterly report, after which their share price has jumped 7.5% to A$8.47 at the end of the week (market close), in comparison to A$7.88 at the time of their quarterly report release. This response was driven by positive investor sentiment, as Evolution Mining announced record group mine cash flows, increasing the projected operating mine cash flow by 27% to approximately A$2.3 billion, enabling increased returns to shareholders. Additionally, the company saw a significant 27% increase in their cash balance to A$661 million, and a resultant early debt repayment that reduced their gearing ratio by 4% QoQ to 19% The group’s gearing ratio has constantly been decreasing over time, with a 6% decrease since June 2024 and a significant 14% decrease since September 2023 . Moreover, their Mungari mill expansion was delivered ahead of schedule at 9% under their projected budget, further driving positive investor sentiment.

Lastly, the ASX All Ordinaries Gold Index has seen a significant upward movement this week, rising by nearly 500 points to 12,680 points, nearly an all-time high. Quite obviously, the primary driver in this movement is the record-high gold prices, which in-turn rely on favourable developments in the macroeconomic environment, which seems to be conducive for gold in the near-term, due to a weakening dollar, inflationary scares, and a relatively higher probability of interest rate cuts, coupled with increased spending on gold from the central bank. Additionally, analysts have pointed to substantial EPS upgrades among precious metals and mining companies, due to positive gold price forecasts, and average AISC costs that aren’t able to keep up pace with increasing gold prices, leading to a two-pronged operating margin expansion for precious metals and mining companies.

To summarize, gold’s bull run may have seen a slight correction this week, with investors wanting to square off their profitable positions and save themselves from a potentially overbought trend, but any correction in prices point towards a buy at the moment, in light of the uncertain macroeconomic environment, which will ultimately push investors to the safe-haven asset that is gold.