Find great entry points for gold producers using GoldHub Australia metrics

April 12, 2025Hi! I am Jimmy, the team in building GoldHub Australia. I have been trading gold and related mining stocks for over 8 years now, and it certainly has been rough. Hence came GoldHub Australia, founded with my friend Brian whom I learned a lot from on trades in the past, and we aim to make trading more systematic to help make more successful trades.

Since GoldHub introduced the valuation module early this year, I will share my recent trade stories using this tool on two mining stocks, Bellevue Gold and Westgold Resources. They are both mid tier strong growth gold mining companies, hence they have the potential to go a lot higher in share price in the coming years, and they have both been in my watchlist for a while.

How does GoldHub valuation work?

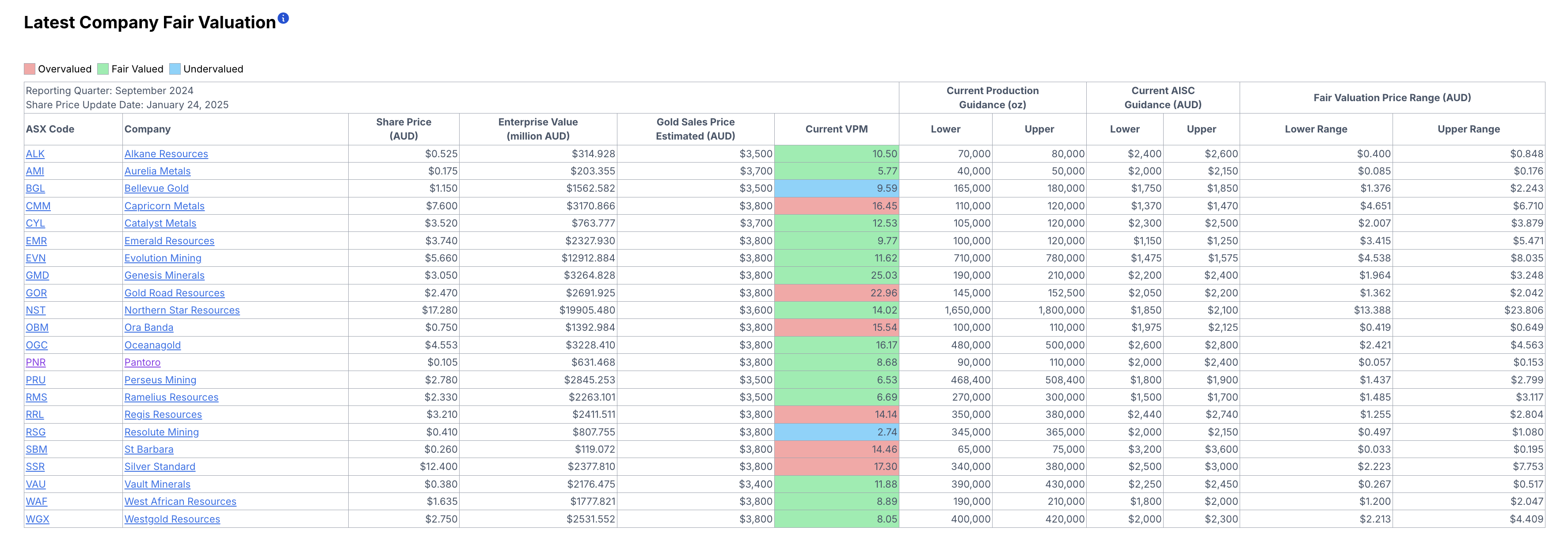

GoldHub provides stock price valuation for every gold producer stock GoldHub Australia monitors, and it is classified by "undervalued", "fair valued" and "overvalued". The valuation is calculated via the most recent guidance from the company, and estimated gold sale price. Therefore we can get a quantitative valuation with the gold it will potentially mine and sale compared to its share price.

Bellevue Gold (BGL.ASX)

Bellevue Gold is the top 10 biggest gold producers in Australia, with high grade gold resources and reserves. On 24th January, the tool showed an "undervalued" signal, which triggered my attention.

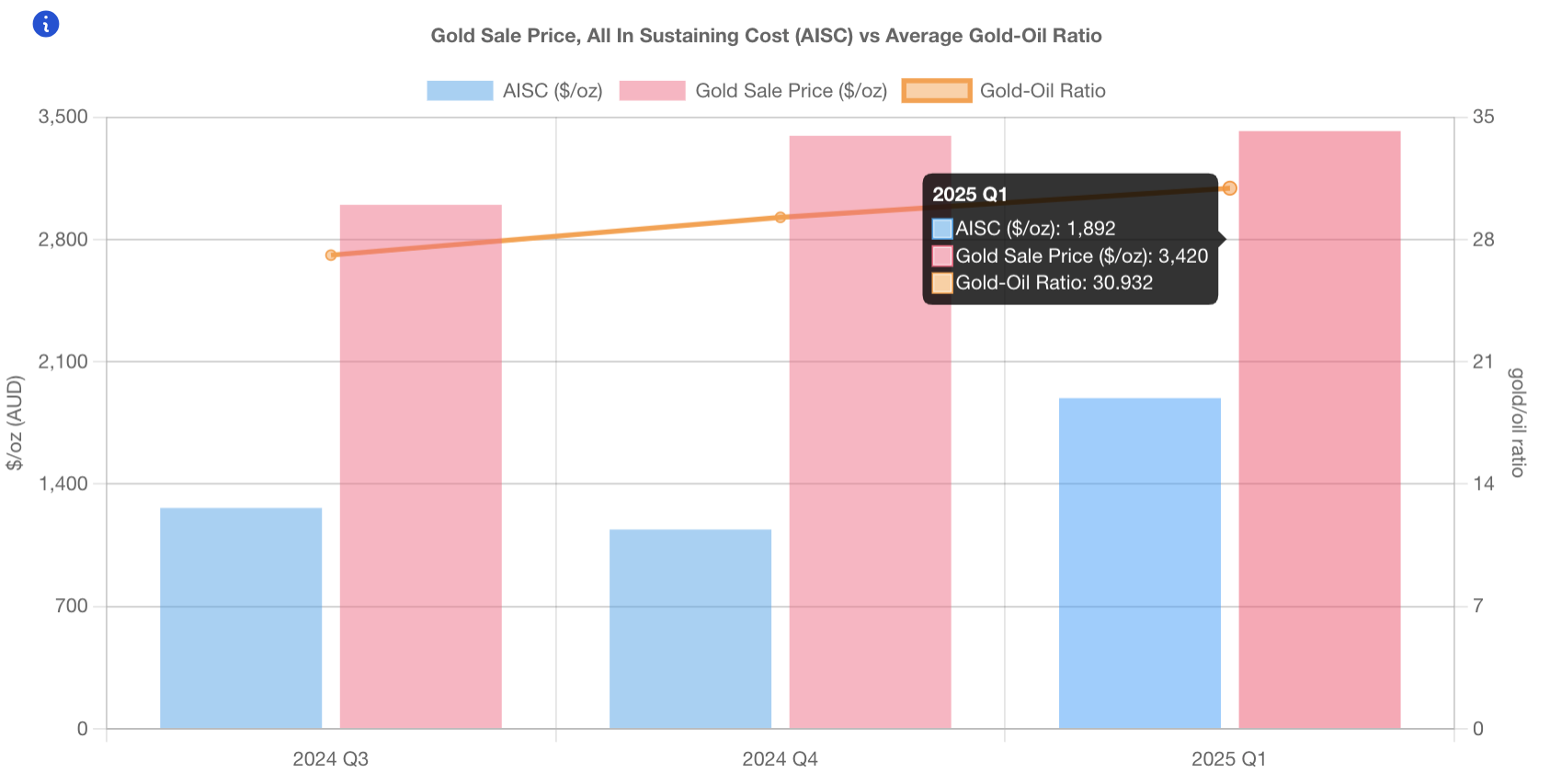

I went and looked at the fundamentals through GoldHub company analysis, and it looks like due to higher ASIC, the investors are not as confident as before, hence the sell off. However with the high gold sale price it is still making a lot of money.

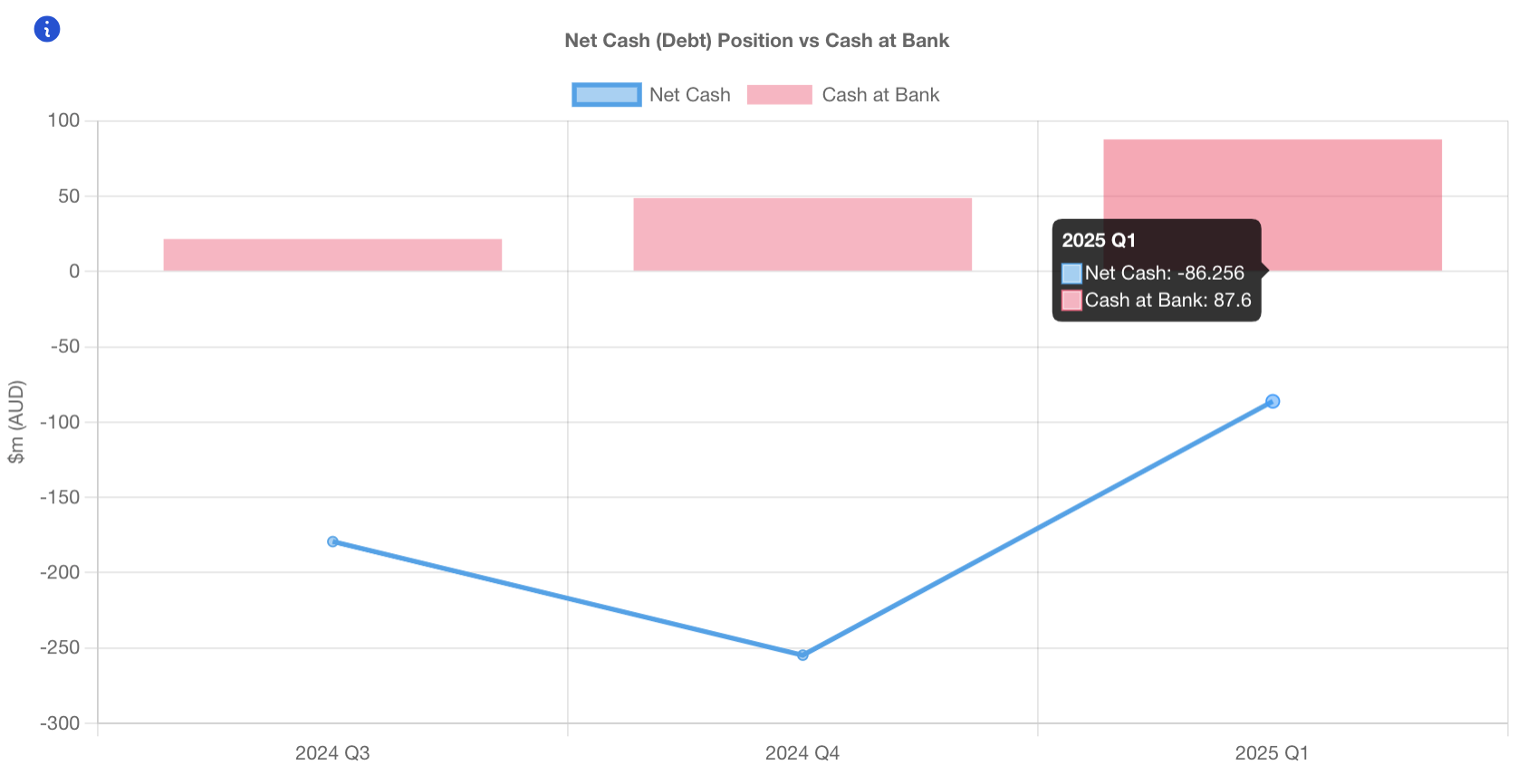

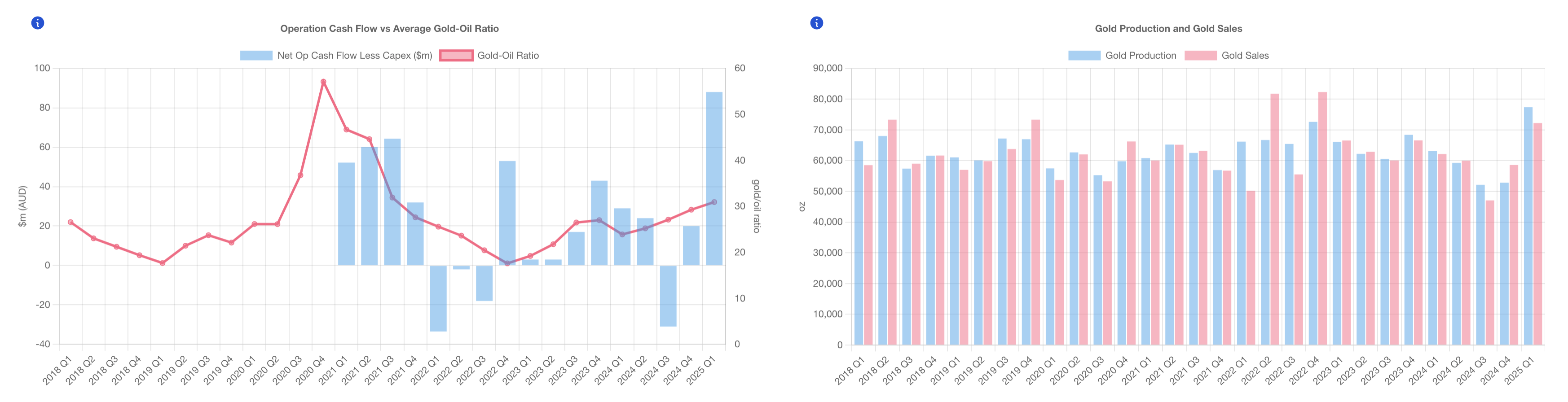

Now if you look at the cash position, while it is still negative, which has certain fragility, it is actually improving! Therefore I think it is a good enough company to buy, and as long as the company improves its mining operation, this company should do very well, especially since it is already in an oversold position in regard to share price.

Therefore I decided to buy on around 28th January with a price point of 1.085 per share. It jumped to 1.2 the next day, a 10% gain in a day! While it is very lucky to make money on the first day, you can see that other buyers also think it is undervalued.

Westgold Resources (WGX.ASX)

Westgold Resources is the top 15 biggest gold producers in Australia.

On Feb 2nd, the tool showed an "undervalued" signal, which triggered my attention.

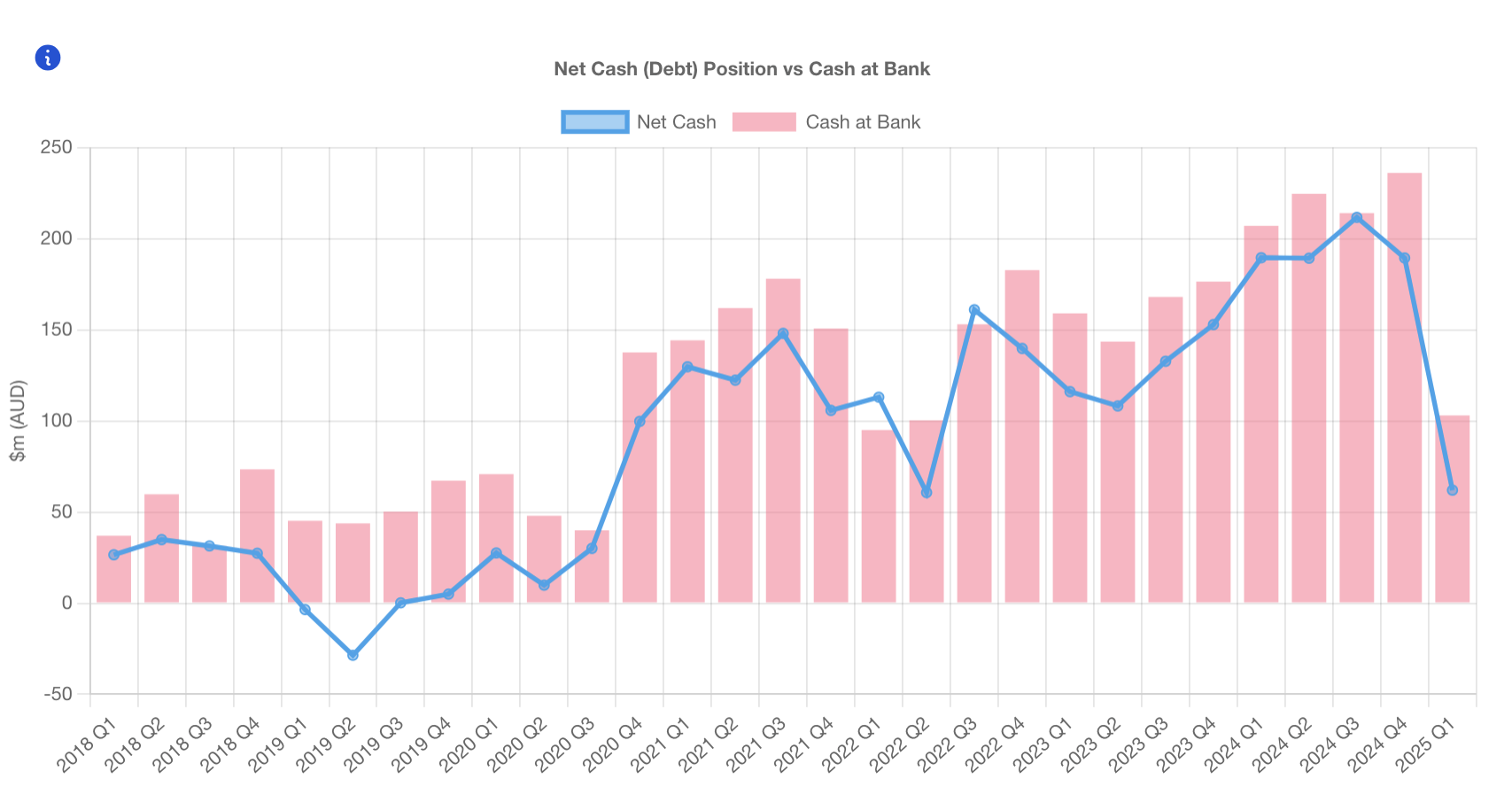

I reviewed the fundamentals through GoldHub company analysis, and the cashflow is strong, and due to recent acquisition, gold production has significantly increased. Company looks healthy to me.

The cash in the bank is drastically reduced! However, this is due to a recent acquisition, so it is reasonable.

Therefore, after reviewing the fundamentals, I decided to find an entry point to buy in.

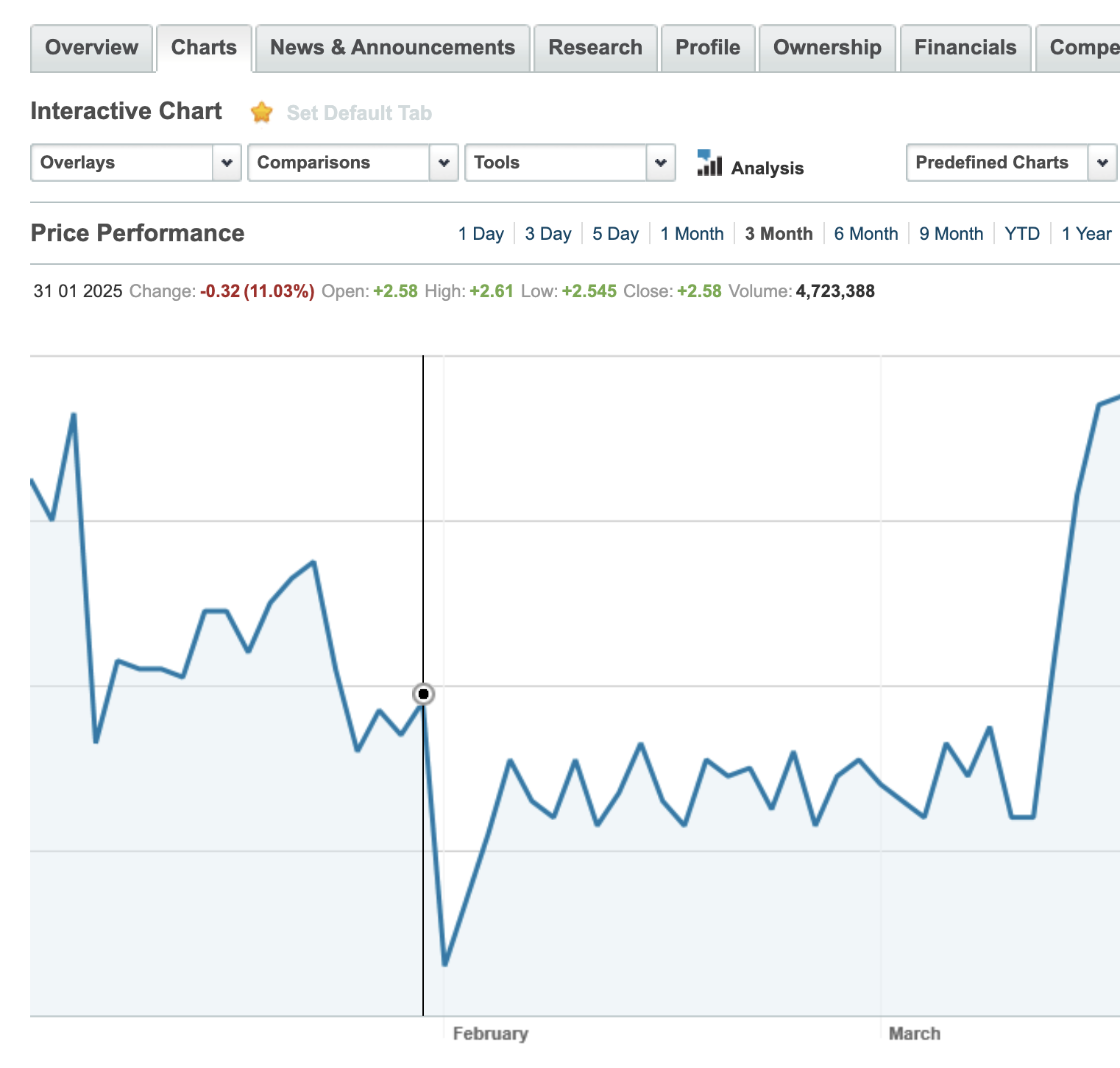

On 3rd Feb, the stock price fell by 10% from $2.58 to $2.26! What happened? Apparently due to the recent acquisition, the company provided an overly optimistic guidance, but as with most acquisitions, there are more challenges with the acquisition than anticipated, so they released a more realistic guidance on 3rd Feb. Apparently a lot of investors did not believe in that guidance, causing the price to reach "undervalue" status, and the new guidance is so bad it had to correct 10% to reach the new price.

With the new guidance, the valuation module updated the valuation to "fair value" status, so it was actually a value trap!

I was fortunate to have bought in at $2.27 after the fall, and pinpointed a low point for a quality stock such as Westgold. It was a great lesson for me to be reminded not to just check valuation, but also to understand the reason why it became undervalued in the first place to make sensible judgement.

Conclusion

As you can see from above two stories, valuation is never easy, as it relies on data we have from company, and things can change quickly, and to make a smart buy is more than just looking at valuation, but having a good understanding of where the company is at and why the price might be undervalued. Nethertheless, it is a useful signal tool to help you find a point in time where the potential value and perceived value by the market is not in sync, and it might provide a good entrypoint for purchase. These are not financial advice, purely a point in time experience sharing.

If you find this interesting and want to learn more, welcome to sign upto our service. We provide a selection of companies for you to navigate for free and learn!

For a limited time, you can use the promo code AGRGOLDHUB to get 40% off the first year of subscription.

Brian contributes his insights on precious metals and mining stocks via free and paid newsletters with independent publisher, Fat Tail Investment Research. You can learn about his work by visiting www.daily.fattail.com.au. Fat Tail Investment Research is part of The Agora, a renowned international financial solutions publisher.

Disclaimer: None of our content constitutes financial advice nor endorsements and recommendations for any organisations, companies, and products. Please seek a professional financial adviser before you make any decisions arising from our videos, articles and other published material. All those featured in our videos express their opinions and may not reflect our views. We support freedom of speech, thought, and expression.